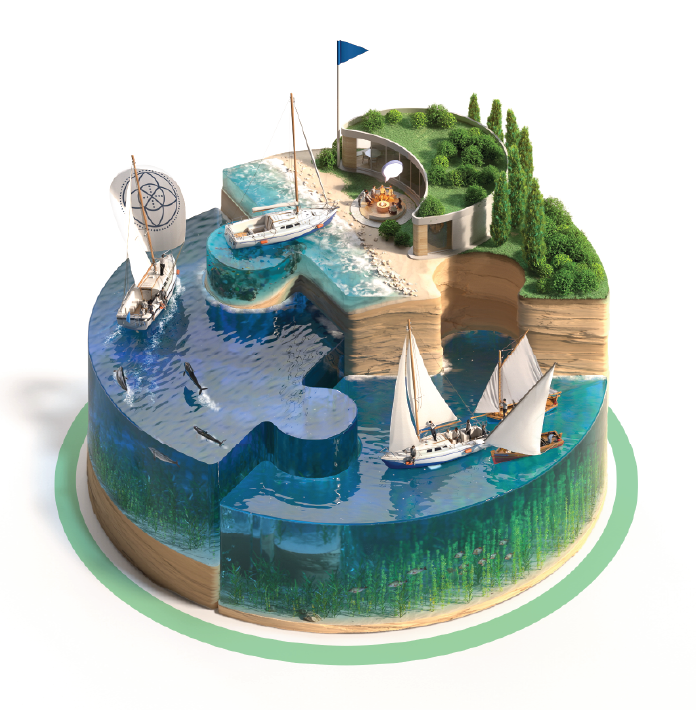

Business Solutions

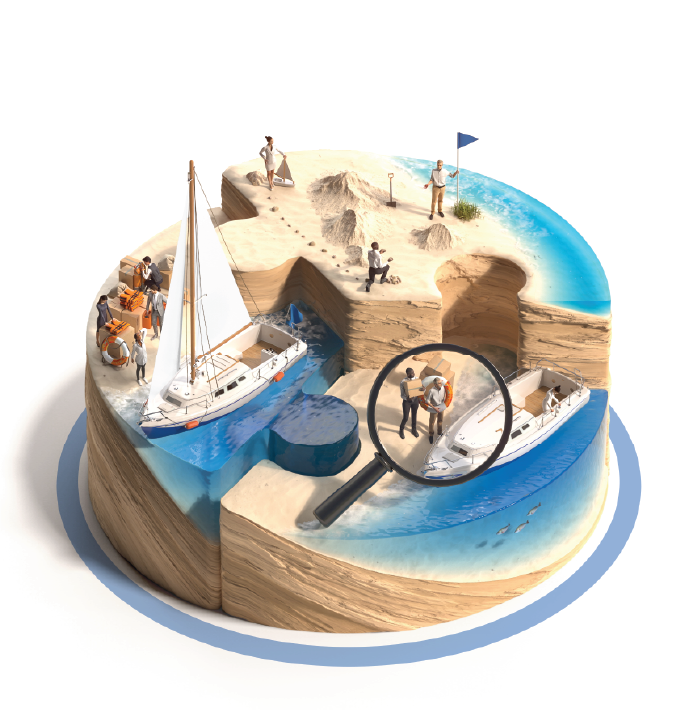

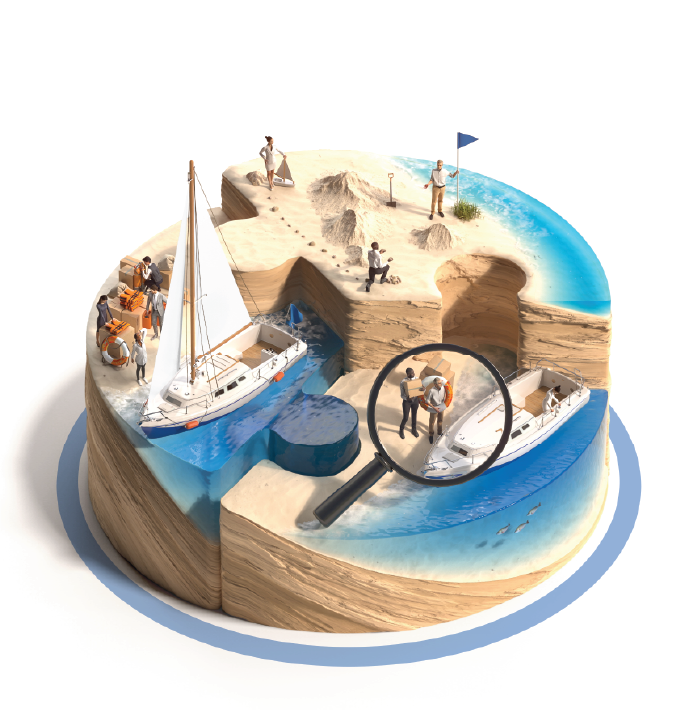

Finance Solutions

Who we Are

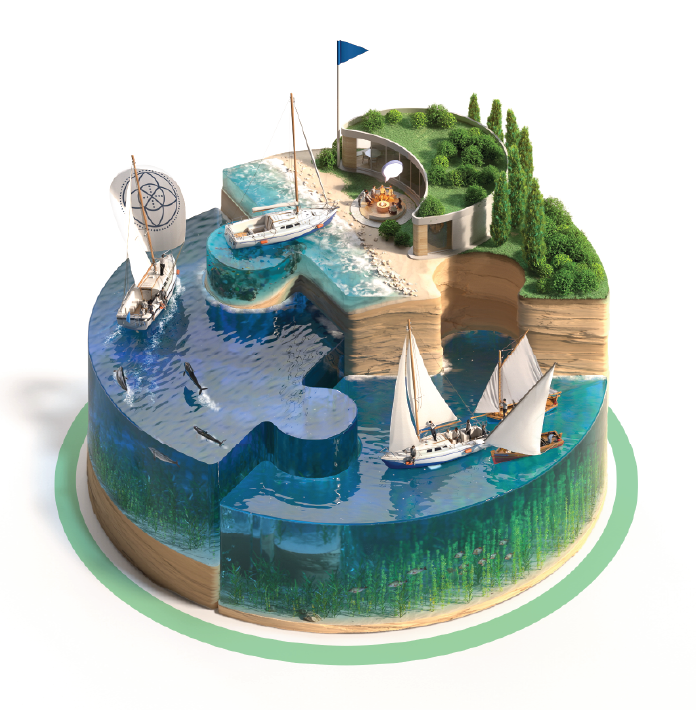

Whether you need support to upskill your stakeholders, better assess ESG risks, or develop sustainable investment products, our innovative finance solutions are here to support you at every step of your journey.

We help you unlock the full potential of the green industrial revolution.

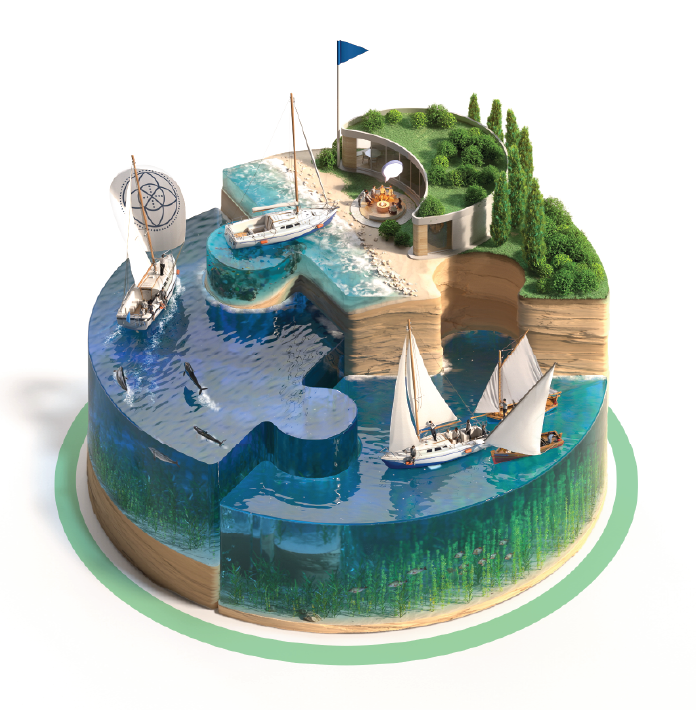

Our A to Z suite of consultancy solutions helps you overcome the most critical challenges when driving, planning and implementing robust ESG and impact strategies.

We help you unlock the full potential of the green industrial revolution.

Stakeholder engagement and upskilling

/ Leadership Engagement

Support C-Suite & board strategic thinking

/ Stakeholder Mobilisation

Engage your employees, clients & portfolio companies

/ Technical Training

Upskill key stakeholders to meet your goals and regulation

ESG analysis & strategic planning

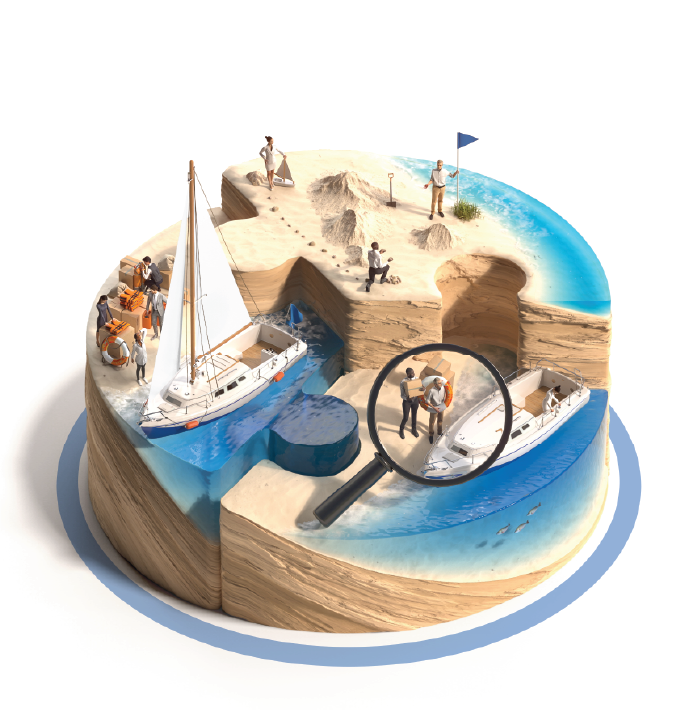

/ State of Play Analysis

Assess your in house ESG status and risk exposure

/ Opportunity Analysis

Identify how sustainability can boost your performance

/ Strategy Design/upgrade

Create a high impact, future-proof sustainable investment strategy

Implementation and communications

/ Implementation Partners

Integrate the best people, partners and tools for active stewardship

/ Positive Impact Solutions

Offsetting, philanthropy & CSR activities

/ Communications Support

Brand narrative, reporting, product marketing & events

Each module is a synthesis of industry best practice and our unique approach to solution design. They are delivered by our experienced, interdisciplinary consultants and combine innovative processes, tools and technologies, with a global partner network to deliver measurable results.

We understand ESG investment realities and its many challenges (investor preferences, data complexity, lack of resources). We work with you and for you to develop solutions that deliver the tangible KPIs needed to support your multiple objectives.

Our innovative 'super framework' was designed to be the most advanced full spectrum in house sustainability strategy management tool available - and yet, be as non restrictive and easy to use as possible. No greenwashing with us.

Whatever your size or location(s), our ability to operate entirely digitally as well as in situ means you can include as many stakeholders as needed with less downtime and costs. We also translate the complexity to help you optimise participation.

We are finance, environmental, policy and business experts. We help you respond to both current and upcoming standards, trends and regulations - ensuring your investments are truly resilient, profitable, sustainable and future-proof.

Former governor Bank of Canada & Bank of England. UN Special Envoy on Climate, co-founder of Gfanz & TSVCM

Intesa San Paolo acquired REYL with the aim of making it Europe’s first impact private bank. We were commissioned to help their Chief Impact Officer produce a mandatory ESG training programme for their entire workforce and develop a strong narrative around impact investing.